opening work in process inventory formula

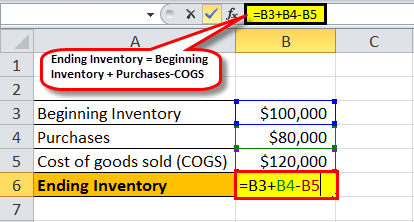

See the formula for calculating ending inventory above. Next multiply your ending inventory balance with how much it costs to produce each item and do that same with the.

Determine the cost of goods sold COGS with the help of your previous accounting periods records.

. Cost of Goods Manufactured COGM Total Factory Cost Opening Work in Process Inventory - Ending Work in Process. Beginning Inventory Formula COGS Ending Inventory Purchases. Ending inventory Beginning inventory Inventory purchases Cost of goods sold or Ending Inventory Beginning Inventory Inventory Purchases.

Imagine BlueCart Coffee Co. Finished Goods Inventory Beginning Finished Goods Inventory COGM - COGS. Lets use a best coffee roaster as an example.

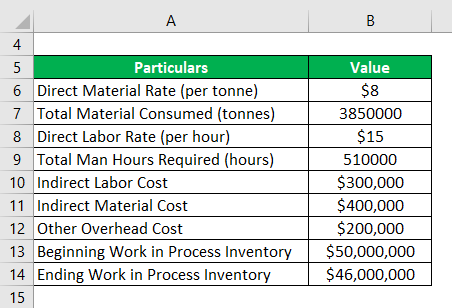

Its ending work in process is. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing Cost Ending Work in Process Inventory.

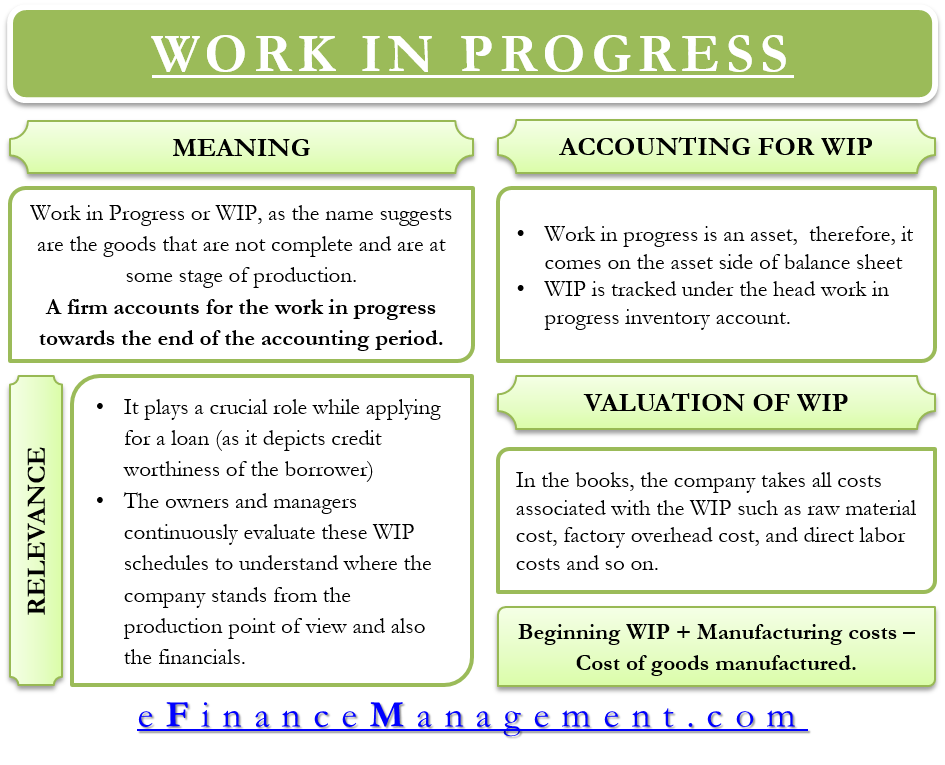

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead. But if you already know the beginning inventory and ending inventory figures you can also use them to determine the cost of goods sold.

The last quarters ending work in process inventory stands at 10000. Has a beginning work in process inventory for the quarter of 10000. Cost of goods sold - formula.

Inventory turnover is a ratio that measures the number of times inventory is sold or consumed in a given time period. Formulas to Calculate Work in Process. Beginning Work in Process WIP Inventory.

WIPs are considered to be a current asset on the balance sheet. Let us take a company ABC which manufactures widgets. Every dollar invested in unsold inventory represents risk.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Formula to convert operating income to net income. The finished goods inventory formula is.

The value of all materials components and subassemblies representing partially completed production at plant cost for the most recently completed fiscal year. 5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured. Production in terms of.

Work-in-process WIP inventory turns This asset management measure is typically calculated as the cost of goods sold COGS for the year divided by the average on-hand work-in-process material value ie. The initial work in process amount manufacturing expenses minus the cost of manufactured goods is the work in process formula. How to Calculate Ending Work In Process Inventory.

Calculating your beginning inventory can be done in four easy steps. Work in process inventory formula. Accounting with Opening and Closing Work-in-Progress-FIFO Method.

And long story short heres the formula. And the result for calculating beginning inventory cost will be as follows. The cost of manufacturing is considered in the raw materials account the work in progress account.

Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have. To the inventory accounts the inventory costs are debited till the manufacturing process is completed or the inventory is sold completely. This is also known as work in process or finished products account.

Cost of Goods Manufactured 530 million. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. That is how to find beginning inventory.

Ending Work in Process WIP Inventory COGM. The formula for the cost of goods sold is Opening stock Purchases Closing. However it excludes all the indirect expenses incurred by the company.

Opening Stock Formula Sales Gross Profit Cost of Goods Sold Cost Of Goods Sold The Cost of Goods Sold COGS is the cumulative total of direct costs incurred for the goods or services sold including direct expenses like raw material direct labour cost and other direct costs. Cost of Goods Manufactured is calculated using the formula given below. The Formula to Calculate the COGM is.

4000 Ending WIP. Total Manufacturing Costs Beginning WIP Inventory Ending WIP. Formula to convert operating income to net income.

1500 x 20 30000. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. Oi ni 1 tax rate revenue budget.

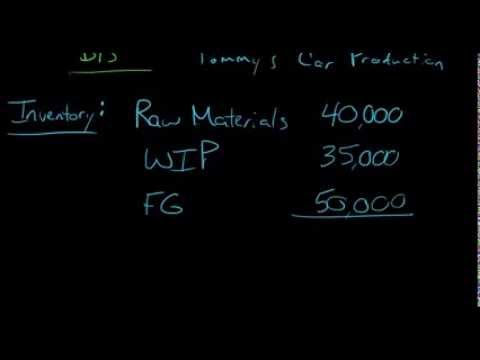

COGS Beginning Inventory Received Inventory- Ending Inventory Finished Goods Inventory Formula. FIFO method assumes that those units which represent work-in-progress at the beginning are completed first and the units partly complete at the end of the period are units introduced or transferred from the preceding process during the current period. 44000 30000 14000.

Subtract the amount of inventory purchased from the number above to calculate the value of beginning inventory. Each accounting cycle starts with an amount for the beginning work in process. Cost of Goods Manufactured 450 million 480 million 400 million.

Opening work-in-process inventory closing work-in-process inventory cost of goods manufactured. Ending inventory Previous accounting period beginning inventory Net purchases for the month COGS. The work in process formula is.

Budgeted sales qty x sp. Cost of goods manufactured. Example Calculation of Cost of Goods Manufactured COGM This can be more clearly seen in a T-account.

By simplifying the above formula we can say cost of goods manufactured is basically. Add the ending inventory and cost of goods sold. Beginning Work in Process WIP Inventory.

Work in process inventory AKA work in progress or WIP inventory is everything that happens to inventory in between raw materials and finished goods. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. Work in process inventory formula.

Cost of Goods manufactured Direct materials cost Direct labor cost Factory overhead cost Opening work in process inventory - Ending work in process inventory.

Ending Inventory Formula Step By Step Calculation Examples

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Work In Process Wip Inventory Youtube

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Wip Inventory Definition Examples Of Work In Progress Inventory

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Cost Of Goods Manufactured Formula Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

What Is Work In Progress Wip Finance Strategists

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Cost Of Goods Manufactured Formula Examples With Excel Template

Ending Inventory Formula Step By Step Calculation Examples

Ending Work In Process Double Entry Bookkeeping